Financial Planner St Johns MI

GLIDEPATHS: EVOLVING WITH YOU

To help ensure your portfolio works well for your investment timeline and preferences, GWP gives you a portfolio glidepath. Rather than one static allocation that would essentially remain the same while you’re invested with us, the glidepath slowly changes your allocation over time. This means you’ll receive a starting allocation based on your years to retirement and your risk preferences, as well as an allocation path that will update your investment mix each year until you reach retirement. This path makes your portfolio more conservative as you approach your investment goal—in this case, retirement.

Why a Glidepath?

A glidepath allows your portfolio allocation to adapt as you approach retirement. Without a glidepath, your portfolio might remain too aggressive for your investment time frame. If you have a long time until retirement, for example, it makes sense to have a more aggressive portfolio, because you can potentially earn higher returns over time through rising markets, and you have time to rebound from any market fluctuations. But as you approach retirement, you have less time to recover from potential market dips, so you need a more conservative portfolio. There is no guarantee that the GWP glidepaths will provide adequate income at and through your retirement.

CREATING THE RIGHT PORTFOLIO FOR YOU

To get your initial portfolio allocation and the glidepath your account will follow, GWP will take you through three steps. These ensure you receive a portfolio designed for you, your goals, and your preferences.

1 What’s Your Investment Horizon?

You’ll begin by answering a few questions about yourself and your plans for your investments, including your age and intended retirement date. Your investment time frame is the key factor in determining your initial portfolio allocation.

2 What’s Your Risk Tolerance?

Next, you’ll answer a series of risk tolerance questions to help us understand your investment preferences. We’ll seek to discover if you prefer:

- Taking on more risk, which means you’ll receive more equity exposure in your portfolio

- Taking on less risk, which means you’ll receive more fixed income exposure in your portfolio

- A mixed approach, which means you’ll receive a balance of equity and fixed income exposure in your portfolio

Your risk tolerance will determine the “tilt” to your portfolio—whether you have more equity or more fixed income investments or a balance of the two.

3 Receive Your Investment Objective

Combined, your years to retirement and your risk preferences will give you your investment objective. You’ll receive one of the following five objectives:

- Aggressive Growth: Emphasis is placed on aggressive growth and maximum capital appreciation. This portfolio has a very high level of risk and is for investors with a longer time horizon. This portfolio is considered to have the highest level of risk.

- Growth: Emphasis is placed on achieving high long-term growth and capital appreciation. This is considered higher than average risk.

- Growth with Income: Emphasis is placed on modest capital growth. Certain assets are included to generate income and reduce overall volatility.

- Income with Moderate Growth: Emphasis is placed on current income with some focus on moderate capital growth.

- Income with Capital Preservation: Emphasis is placed on current income and preventing capital loss. This is considered the lowest risk portfolio available and is generally for investors with the shortest time horizon.

This investment objective will determine your starting allocation and future glidepath.

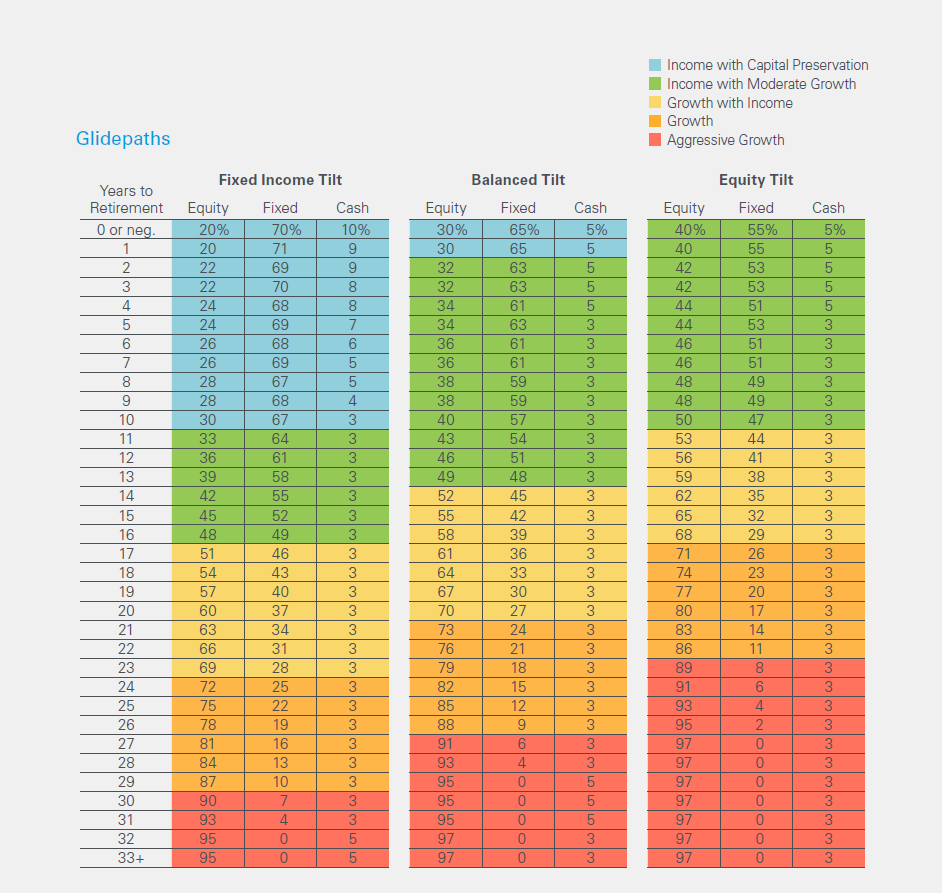

GLIDEPATHS

In the chart above, you’ll see the various glidepaths available. By combining your years to retirement (left column) and your risk tolerance (top row), you get your starting allocation. For example, if you have 20 years to retirement and prefer a more aggressive approach (equity tilt), you’d have a growth strategy, and your starting allocation would be 80% equities/17% fixed income/3% cash. Your glidepath then gives you your allocation each year as you get closer to retirement. In this example, in the next year— year 19—your allocation would move to 77% equities/20% fixed income/3% cash.

It’s important to know that more weight is given to your investment time frame than your risk preferences when you begin investing. For example, you could answer the risk tolerance questions conservatively, but start out with a more aggressive portfolio, because you have a long time until retirement. As you get older, however, your risk tolerance will hold greater weight and your portfolio will shift toward a more conservative allocation.

There is no guarantee that the GWP portfolios will achieve their stated investment objectives.

Guided Wealth Portfolios (GWP) is a centrally managed, algorithm-based investment program sponsored by LPL Financial LLC (LPL). GWP uses proprietary automated computer algorithms of FutureAdvisor to generate investment recommendations based upon model portfolios constructed by LPL. FutureAdvisor and LPL are nonaffiliated entities. If you are receiving advisory services in GWP from a separately registered investment advisor firm other than LPL or FutureAdvisor, LPL and FutureAdvisor are not affiliates of such advisor. Both LPL and FutureAdvisor are investment advisors registered with the US Securities and Exchange Commission, and LPL is also a member FINRA/SIPC. There is no assurance that Guided Wealth Portfolios are suitable for all investors or will yield positive outcomes. The purchase of certain securities will be required to effect some of the strategies. Investing involves risks including possible loss of principal.

PM-4670-0118 Tracking #1-672609 (Exp. 02/20)